Finance adviser Salehuddin Ahmed is set to unveil a Taka 790,000 crore (7.9 trillion) national budget for the fiscal year 2025–26 (FY26) Monday, highlighting key issues like creating new jobs, reducing inflation, facilitating trade and commerce and restoring economic stability alongside fiscal discipline.

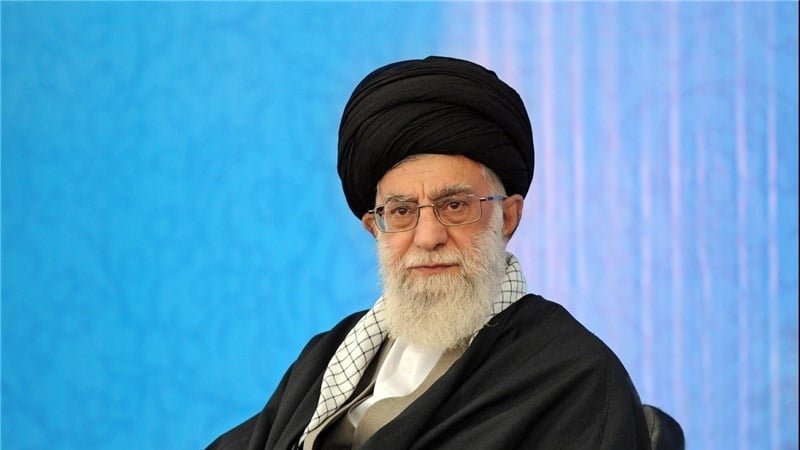

This will be the country’s 54th budget and the first of professor Muhammad Yunus led interim government.

The national budget for FY26 will be announced at a time when the interim government, led by Nobel laureate professor Muhammad Yunus, after taking charge following the ouster of Sheikh Hasina regime in the wake of a student-led mass uprising. It will focus on guiding the economy into stability amid mounting pressures.

The maiden budget for the interim government also faces an uphill task of curbing inflation further, streamlining private investment and foreign direct investment (FDI), restoring fully fiscal discipline and strengthening the social safety nets amid global and domestic uncertainties.

Finance adviser Salehuddin Ahmed will deliver the budget speech in a pre-recorded broadcast scheduled for 3:00 pm on Bangladesh Television (BTV) and Bangladesh Betar.

Private television channels and radio stations have been requested to air the speech simultaneously, using BTV’s official feed.

Finance division officials said the budget for the next fiscal year will focus on boosting the tax-GDP ratio, facilitating the local industries, attaining desired revenue collection growth, creating new employments, attracting FDI, creating business friendly environment, minimising compliance gap, simplifying the accounting system of VAT.

Besides, there is likely to be simplification of some provisions of the concerned law for rationalising the supplementary duty rate to attain desired target in VAT collection.

Compared to the previous year, the next budget is likely to be Taka 7000 crore lower than the current fiscal year’s original allocation of Taka 797,000 crore.

Finance ministry officials said that formulation of the budget for FY26 is being done aligning with the government’s priority on fiscal consolidation, delivering a more implementable and efficient financial plan.

While giving a recent interview to BSS, the finance adviser said that the national budget for FY26 would be time-befitting and practical-based having implementable approaches since the interim government has considered all the macroeconomic and social issues while framing the budget.

“I won’t say this budget (FY26) is small, but it will definitely be implementable and time befitting. It will be time befitting as issues like inflation, trade, foreign currency reserves, facilitating trade, commerce and businesses, harnessing revenue mobilisation are being considered. We’re considering all these issues and thus making the budget as practical-based,” he said.

Compared to the previous year, the overall size of the budget is likely to be slightly smaller -- Taka 790,000 crore, down 0.87 per cent from the current fiscal year.

The development budget will be reduced by Taka 35,000 crore (350 billion) to Taka 230,000 crore (2.3 trillion), while the revenue budget will go up by Taka 28,000 crore (280 billion)to Taka 560,000 crore (5.6 trillion).

Fiscal policy will prioritise tighter coordination with monetary policy while the budget is expected to reflect recommendations from key reform commissions and taskforce reports.

Around 57 per cent of the revenue budget is likely to be earmarked for salaries, subsidies, incentives, and debt servicing. Allowances and salaries alone are expected to reach Taka 82,000 crore (820 billion).

The budget may also introduce dearness allowances for government employees.

Subsidy expenditure is expected to reach a total of Taka 116,000 crore (1.16 trillion) while interest payments may account for around 22 per cent of the revenue budget.

The projected budget deficit for FY26 is likely to remain below 4 per cent of GDP as it is likely to stand at Taka 226,000 crore (2.26 trillion), down from Taka 256,000 crore (2.56 trillion) in the current fiscal year, representing 3.62 per cent of the GDP.

To meet the budget deficit, the government will rely on foreign borrowings, bank loans, and selling of savings certificates.

The finance division officials said a possible moderate GDP growth target of 5.5 per cent has been set for FY26, slightly higher than the revised 5.25 per cent for the current year.

Inflation control will remain a priority with the government aiming to bring it down at around 6.5 per cent.

To alleviate the financial strain on lower-income groups, the budget includes an expansion of social safety net programmes, increasing both beneficiary numbers and allowance amounts.

Key sectors like agriculture, health, education and technology would be prioritised for availing funding.

The Annual Development Programme (ADP) allocation is projected at Taka 230,000 crore (2.3 trillion), a reduction from Taka 265,000 crore (2.65 trillion) in the current fiscal year, signifying a more focused investment approach.

Salehuddin Ahmed has assured that the upcoming budget will be business-friendly, introducing tax policies designed to enhance investment, GDP growth and job creation.

The revenue collection target for FY26 is likely to be at Taka 518,000 crore (5.18 trillion), up from Taka 480,000 crore (4.8 trillion) in the current fiscal year.

Non-development expenditures will rise, with major allocations earmarked for debt servicing, food subsidies, and banking sector reforms.

The non-development budget is expected to reach Taka 560,000 crore (5.6 trillion), an increase of Taka 28,000 crore (280 billion) compared to the current fiscal year’s allocation.

The government also plans to strengthen the banking sector with a dedicated allocation to cover the capital shortfall of state-owned banks. Besides, subsidies for agriculture, fertilisers, and electricity will continue to support key industries.

The next budget is also likely to see steps to reduce the cost of doing business and align tax policies with the requirements of LDC graduation.

In the budget, emphasis would be placed on curbing public spending and reducing the budget deficit.

There will be no expenditures which will temporarily appease the public but ultimately burden future budgets.

Long-term projects are not being included in the development budget, and no new mega project is being initiated — except for the Matarbari development project, which was already in progress.

This project is being financed by Japanese loans, which are long-term in nature. To avoid increasing the debt burden, no short-term or high-interest loans are being taken.